Hola everyone! As promised last time, I am here to row your sails through all your tax-related woes, without having to break a sweat! You see, dear old governments around the world impose a certain charge, or tax on whatever its individuals or businesses make in a year, to keep their machinery well-oiled and running. And if you fail to pay up these taxes, there are serious consequences!

Did you know there was a time in the 1970s where the highest tax slab in India was a staggering 85%! Things have certainly sobered since, with the maximum applicable tax slab now being 30% (which is a lot too, btw!)

This time around, the deadline to file your income tax returns (ITR) for the financial year 2023-24 is 31st July, 2024. So, why am I telling you all this in June, a good 30 days before?

Because I have a strong feeling that most of you will certainly procrastinate this to no end, and won't take it up until 30th July. And then, you'd scramble to get your taxes filed in any manner possible, and even end up paying a penalty for filing late returns, or a hefty fee to the CA for bailing you out at the last moment!

And as your foofi, I want you to be on the top of things,well ahead of the deadline. I want to save you from some very unpleasant, portal-crashing, last minute hassles!

And why am I putting you through this ordeal? Because you might just be eligible for a refund (moneyyyyy!), you just might not know it yet. For that, filing your ITR is a must!

That's why I have a task for you. This week, I have for you a list of documents you need to have handy while filing your ITR. All you've got to do is bring them together during the week, in one place. Sounds doable?

Document hunting begins

Let's start with a few simple ones- your Aadhar, PAN card and your bank account details. While you have to disclose all your active bank accounts in ITR, you'll need to choose one where you'd want to receive your tax refunds)

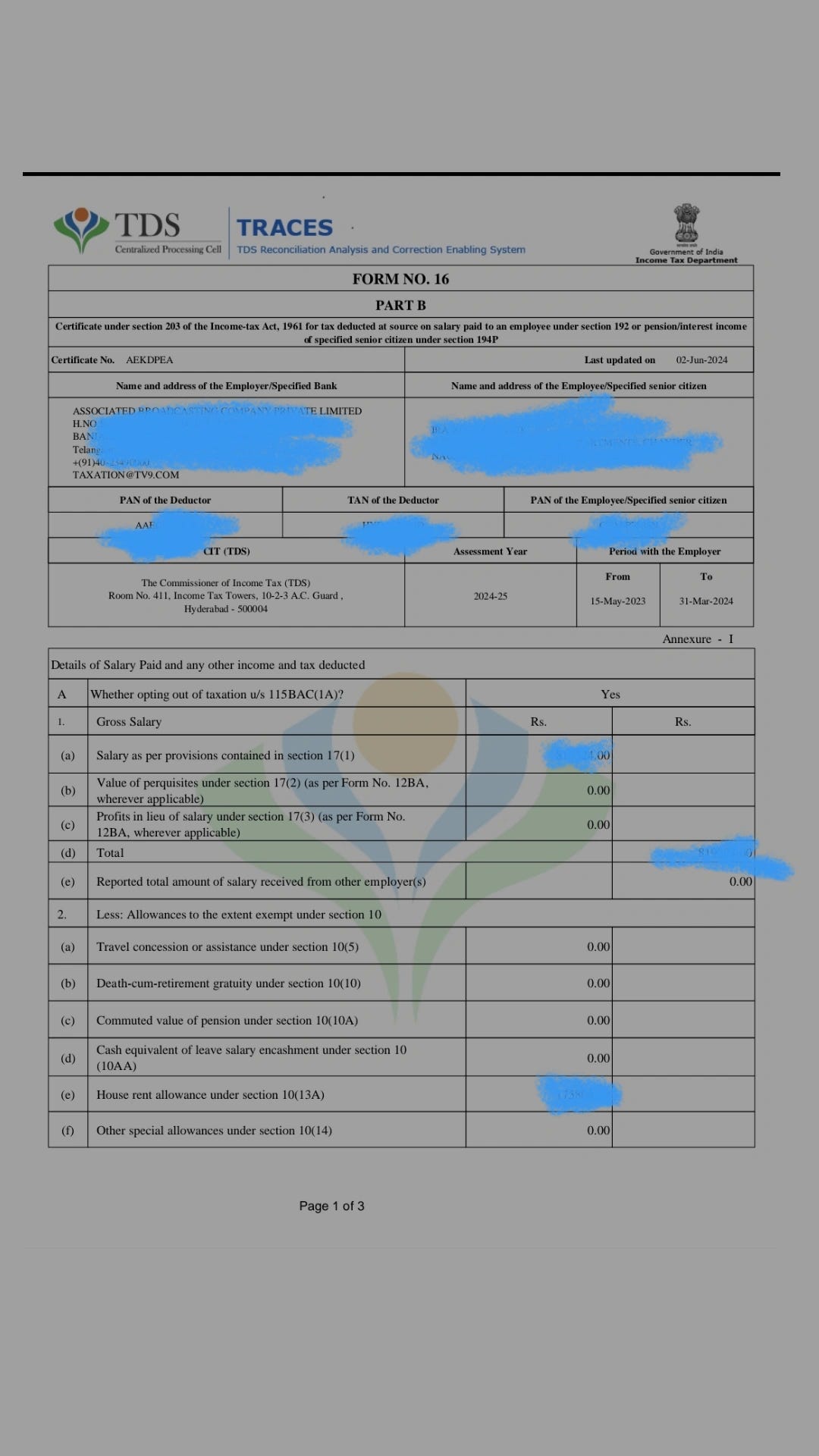

Next, check your work email for something called a Form-16. Here, you'll find a complete breakdown of your salary, your total taxable salary, and how much tax you have to pay. This is issued by the employer to their employees. So, if you have not received your Form-16 for FY 2023-24 yet, check with your HRs at the earliest. It looks something like this :

Up next, have you been a financially prudent corporate/freelancing badass and made investments for your future? Bought any health insurance or term insurance plans? If yes, it's time to put them up for tax-saving!

You are eligible to claim an annual tax deduction of up to Rs 25,000 on premiums paid towards your health insurance policies. In fact, your insurance company will send you a proper certificate to that effect.

As for investments, you can claim an annual tax deduction of up to Rs 1,50,000 by investing in equity linked savings schemes, or ELSS. But remember, you cannot withdraw money from ELSS before 3 years, so invest accordingly.

Can't escape capital gains!

If you've redeemed, or sold some of your investments during the year and earned some profit off them, you'll have to pay the government a little something called a capital gains tax.

Sold a share/mutual fund unit within 12 months of buying it? There's a 15% short term capital gains tax. Redeemed an investment after 12 months? The government has a 10% long term capital gains tax ready for you.

But if your capital gains are below Rs 1,00,000 during the year, you don't have to pay any taxes, so yay, I guess?

If you have invested via apps like Paytm Money, Groww or the like, you can generate statements like realised/capital gains statement, ELSS statement and more within seconds!

Annual Information statement

If you're too bummed out already with the quantum of documents and just want to finish it quickly, I have a hack for you- the annual information statement, or AIS.

Think of this as a one-stop destination for checking where all you've been taxed during the year. Not just TDS deducted by your employer, but also taxes applicable on your investments, or on your property or other high value purchases during the year.

It will even have details of the interest you've earned on your saving bank account as well! (Yes, there's interest on that too!). If there's just one document you might end up getting, it's this!

Pro Tip : You can download the IT department’s AIS app from the play store and find all the information you need right there! Just enter your PAN number, and you're set!

That's all for now! I'll be back next week with a nice, cosy, ready reckoner for tax-related forms! Till then, get to work, ladies! And if you have any progress or issues to share, holler to me within the week :)